Creating a Checklist for Tax Workpaper Preparation

Tax workpapers form the base of accurate tax returns and compliance reporting. They are a part of detailed proof that supports figures, calculations, and decisions in a taxpayer’s return.

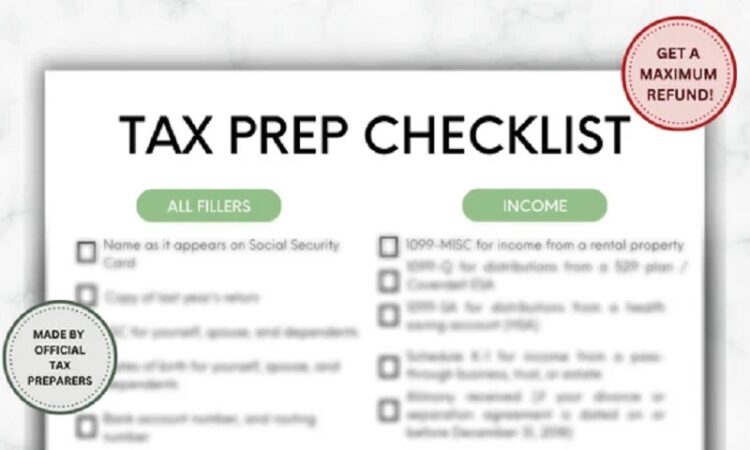

A tabulation acts as a structured guide, helping professionals prevent errors, uphold consistency, and ensure fullness. Below, we outline the key steps and considerations in constituting a comprehensive tabulation for tax workpaper preparation.

Gather All Source Documents

Your record should involve:

- Prior-year tax returns for citation.

- Income statements, balance sheets, and trial balances.

- Bank statements, expense records, and loan documents.

- Invoices, receipts, and cost records.

- Payroll reports and employee benefit proof.

Data Accuracy Verification

After gathering documents, the next step search out and validate their exactness. A checklist should prompt experts to:

- Reconcile bank reports and financial affidavits.

- Check for missing or duplicate efforts.

- Confirm that all income sources are contained.

- Ensure expenses are correctly categorized.

This step reduces the risk of material misstatements and strengthens the accuracy of tax filings.

Organize Workpapers in a Standard Format

Consistency in plan is crucial for both clarity and ease of review. Your checklist should involve items in the way that:

- Using standardized templates for all workpapers.

- Clearly describing files with customer name, year, and document type.

- Including headings, cross-citations, and notes for clarity.

- Ensuring estimates are easy to attend and supported by accompanying documentation.

Review Supporting Schedules and Calculations

Detailed schedules and estimates are often the basis of workpapers. A checklist should cover:

- Depreciation schedules for property.

- Amortization schedules for intangibles.

- Reconciliation of tax supplyings with economic statements.

- Calculation of supposed tax payments and carryovers.

Incorporate Quality Control Measures

Before finalizing, every set of workpapers undergoes character review. A checklist can involve:

- Internal peer review by another tax professional.

- Verification of key figures against source documents.

- Documentation of acceptances and judgments made.

- Use of review notes to address wrongs or gaps.

Finalize, Archive, and Secure Files

The last step of the checklist ensures focus on file finishing and retention:

- Confirm that all workpapers are marked, dated, and inspected.

- Archive digital and physical files in secure, arranged systems.

- Guarantee backup copies are stored in compliance with firm and regulatory procedures.

- Restrict access to impressionable client info to authorized crew only.

Conclusion

Creating a checklist for tax workpaper arrangement is more than just a supervisory tool—it is a framework for exactness, compliance, and effectiveness. By systematically top document collection, data proof, organization, agreement checks, detailed schedules, QA, and secure archiving, firms can ensure their workpapers withstand scrutiny.

In an atmosphere where mistakes can bring about penalties or absent credibility, a well-devised checklist determines the consistency and security needed to transfer reliable tax services. For accountants and tax pros, adopting such an organized approach is not just best practice—it is essential for long-term benefit.